ASEE PSD2ENABLER is a comprehensive solution that helps banks resolve many dilemmas with interpretation of the requirements and turns them into state-of-the-art technical solutions

How does ASEE PSD2Enabler deliver value for the banks?

Seamless integration with other systems, exceptional functionality, and scalability potential make ASEE GDPR the right solution for long-term user data management.

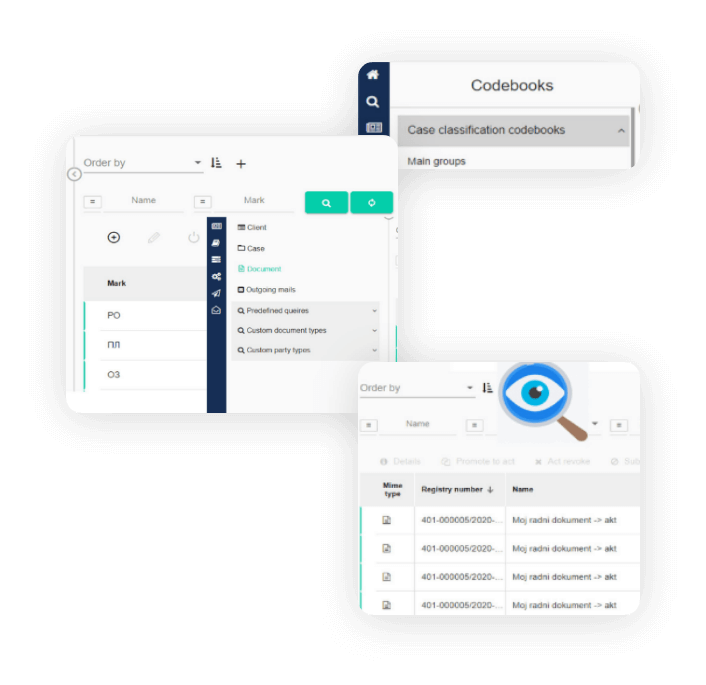

Everything at one place

PSD2Enabler offers a full compliance set with relevant PSD2 requirements, while going beyond compliance with the reference catalog of APIs and PISP/AISP connectors.

Lower risks and less effort

Using a comprehensive, pre-integrated, and certified solution will help banks meet the integration challenges in a shorter time and with lower failure risks.

No implementation complexity

Reducing the complexity and costs with a pre-tested combination of proven API management, identity, MFA, and fraud monitoring components makes our solution a good fit.

Meet ASEE PSD2Enabler features.

ASEE PSD2Enabler main characteristics:

With PSD2 Enabler, ASEE has managed to significantly reduce the complexity and cost of PSD2 compliance and turn banks’ focus on business opportunities.

8 + 4 key components

Asseco PSD2 Enabler package comes with 8 key components to meet regulatory requirements, plus 4 to go beyond compliance.

NextGenPSD2 API specification

PSD2 Enabler with nine key components helps banks achieve PSD2 compliance by meeting more than 150 requirements and offering NISP certification for Berlin Group NextGenPSD2 API specification.

NISP certification

Meeting the requirements for fallback exemption with confidence thanks to NISP certification. NISP-certified and 100% compliant

Have questions?

Send us a message, or call us

Get in touch

Lets connect and start exploring how intelligent way of documentation and process monitoring of internal processes help companies be more productive.

Call us (+48 22) 574 86 30