Up to 30% more efficient customer service enabled by reducing operational mistakes with smart business rules that work behind the scene.

How does ASEE Digital Branch make customers’ lives better?

Predefined processes, which are an integral part of Digital Branch, allow the client to have an identical client experience as on other digital channels.

Personalized servicing

Use of customer data in combination with the power of AI algorithms enables banks to personalize customer servicing and provides fast & accurate information over the most efficient channel for the bank’s client.

BPM and Decision Engine included

Automated, flexible, and result-oriented banking processes for banks that would like to scale and remain the highest quality of business at the same time. We embedded hundreds of processes designed specifically for modern bank operations with the goal of providing effective customer servicing.

Creating a Future-Proof Branch

ASEE Digital Branch Solution ensures that customer experience is at the heart of branch operations, instead of low-value transactions. The solution enables banks to provide a true omni-channel experience with the right mix between a physical branch and advanced technology.

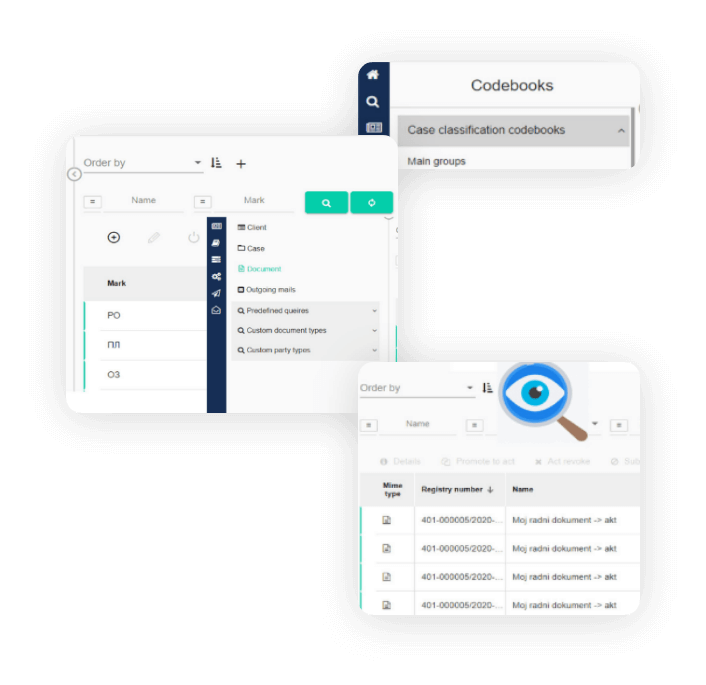

Most loved Digital Branch features:

ASEE Digital Branch main characteristics:

Infrastructure-independent platform

ASEE Digital Banking is an infrastructure-independent platform built to deliver exceptional digital customer experience for the banking apps and workflows.

Easy to integrate solution

Using our APIs, you can start and stop sessions, adjust capacity, and get real-time analytics. We develop this so that functionalities of our platform can be accessed in a programmatic way making it easy to integrate with your existing infrastructure.

Vendor independent solution

Supporting business flexibility, the ASEE Digital Branch solution is vendor-neutral and fit for deep integration with adjacent business applications on your infrastructure.

Results you could expect:

Up to 30%

Better up & cross-sell opportunities

Up to 20%

Saving in operational costs

Up to 4x

Faster customer onboarding

How to start with the ASEE Digital Branch solution?

Meet and exceed customer expectations with flexible and scalable omnichannel banking solutions which let you easily deploy new web and mobile features that make a positive impact on customers’ day to day life over all touchpoints.

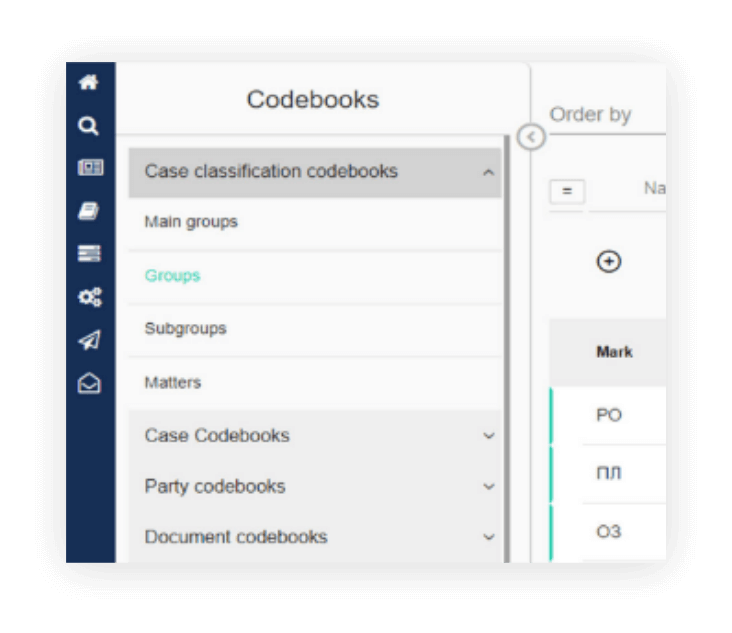

Mark a business critical processes

Define roles, rules and a workflow journey

Start with initial process implementation and a training

Have questions?

Send us a message, or call us

Get in touch

Lets connect and start exploring how intelligent way of documentation and process monitoring of internal processes help companies be more productive.

Call us (+48 22) 574 86 30